Bitcoin ($BTC) is the very first cryptocurrency. It was first used in 2009 and is still the most popular and well know cryptocurrency. In this article we talk about Bitcoin from the very beginning. This article is primarily a fact based, technical view of Bitcoin. We will cover what Bitcoin is, what it could be useful for, but we won’t debate those uses or if it is even it is actually useful for anything at all.

Bitcoin is Money

Bitcoin is money. Let’s compare it to the U.S. dollar ($).

| Currency | Jurisdiction | M0 | M1 | Dollar Value |

| Bitcoin | Global | N/A | 19M $BTC | $2.0T |

| U.S Dollar | U.S | $3T | $18T | $21T |

Money is the value of currency available in the economy, either as hard currency (paper) or digitally (a bank deposit, e.g.). Economists call the paper money M0, while digital money is called M1 (more information at the Federal Reserve website).

Bitcoin is natively digital, so M0 doesn’t exist, though it is possible to print your own bitcoin paper, but this is not common (see below).

U.S. dollars are actually mostly digital today, with only about $3T of hard currency out in the economy.

The U.S. dollar is issued and valid within the U.S. The U.S dollar has been used as a global reserve currency for decades, so dollars are often accepted and used outside the U.S.

Bitcoin is natively digital and global. The computer network that manages Bitcoin is spread all over the world.

As of this writing, the 19 million Bitcoin available is worth over $2 Trillion U.S. dollars.

Bitcoin is a Currency

Bitcoin is a currency.

| Currency | Unit | Smallest Denomination | Total Units |

| U.S Dollar | Dollar | $0.01 | 100 pennies |

| Bitcoin | BTC | 1 Satoshi | 100 million Satoshi |

Bitcoins are denominated into Satoshi. There are 100 million Satoshi per Bitcoin. Similarly, there are 100 pennies per dollar.

As a practical matter U.S dollars are easier to work with. For example, you could buy a pizza for $14. If you wanted to buy the same pizza with Bitcoin, it would be about 13,500 Satoshi.

Bitcoin: What You Own

Let’s compare Bitcoin with U.S. dollars.

All Bitcoin is tracked using a serial number. Technically, this is called a Private Key (PK), and it’s an alphanumeric string not a number.

Possession of Bitcoin means you have the PK. Anyone who possesses the PK can take the money, so PKs need to be safe guided.

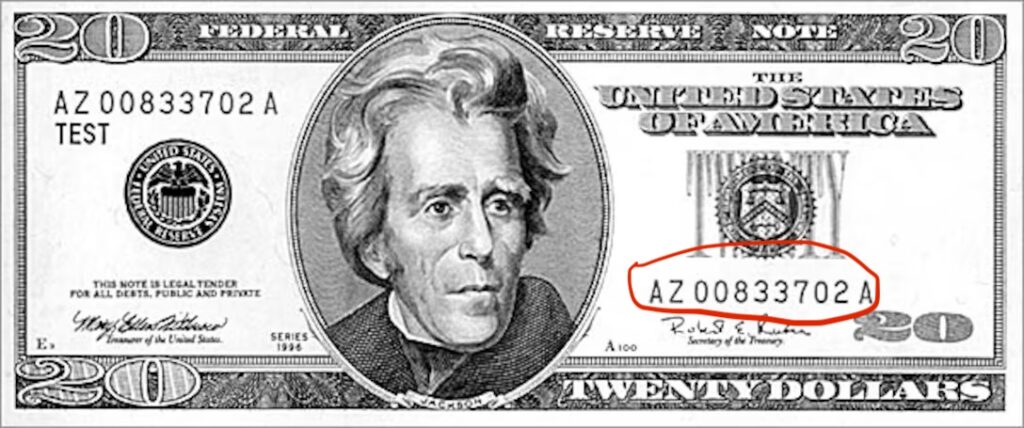

Here is a sample Bitcoin address printed at bitaddress.org. (Please don’t use this address, it isn’t real).

This is an example of making Bitcoin look like U.S. dollars. This isn’t common, PKs are typically kept electronically.

In the case of U.S. dollars, possession of paper money entitles you to ownership.

There is a serial number on paper money, but this number doesn’t have any ownership meaning, it is more of a manufacturer code.

For digital U.S. dollars, your identity and account entitles you to ownership. There isn’t any “key” tied to the money.

For U.S. dollars, there is typically some recourse if your money is stolen. For example, at the bank there is FDIC insurance that protects against bank failure and theft.

Bitcoin ownership requires no account and no identity, just the PK. There is no protection at all against theft or loss. If you lose your PK, the value is gone unless you have a recovery method setup.

Bitcoin: How to Store It

Storing Bitcoin is an important issue. Bitcoin can be used by anyone who has the PK. Many people will go to great lengths to steal or scam you out of Bitcoin.

While this is a concern, the more important concern is actually loss of Bitcoin. Bitcoin can be lost due to forgetting your account, dying, losing the PKs due to computer hardware failure, or even simply deleting your Bitcoin files.

There are ways to store Bitcoin securely depending on how you own Bitcoin.

There are three main ways to own Bitcoin: Bitcoin ETF, full custodial managed, or self custody. (These are in order of increasing difficulty).

Bitcoin ETFs are the easiest way to own Bitcoin. Buy the ETF like a stock, such as iShares Bitcoin Trust ($IBIT). The downside to ETFs is you don’t actually possess the Bitcoin directly.

With full custodial management, an exchange or payment processor securely holds the Bitcoin for you. They manage your account and hold your PKs. It isn’t possible to lose your PKs, because you don’t have them.

Under self custody, you are in control of the PKs and manage the security.

Bitcoin is Permission-less

The concept of permission (or no permission) is very important with Bitcoin. It’s actually important for money, though we don’t often consider it.

If you have U.S dollars in your wallet, the paper itself give you ownership of the money. If you give the paper away, you lose ownership of the money. Similarly, the bank provides ownership of your savings account money, using an account and your identity.

You don’t need permission to own the paper money, but you do need permission to own the money in the bank.

Bitcoin can be possessed without any account and there is no paper. How is this possible?

This is where the concept of permission-less comes into play.

Because all Bitcoin is digitally tracked using the serial number (PK), the knowledge of that key gives you ownership and permission. No permission is required because no one asked you for your identity or had you setup an account.

Bitcoin is Decentralized

The concept of decentralization is also very important with Bitcoin.

We previously mentioned that Bitcoin is global. What his means is that no country owns or issues Bitcoin. Also, no single entity, such as a company or organization, controls it. How is this possible?

There is a decentralized network of global computers that run Bitcoin software (nodes). Each computer has a say in if/when Bitcoin can be transacted. In total, the network must agree through a consensus algorithm for a transaction to be approved.

The Bitcoin network is responsible for approving transactions. As a part of this process, they also create more Bitcoin. It is all orderly and there are software limitations in how much Bitcoin can be created in the short term as well as long term.

Individual Bitcoin nodes can’t steal Bitcoin because they have no access to PKs.

Who Controls Bitcoin?

So far, we are drawing the picture about Bitcoin: a currency that requires no identity, no account and no permission. Also, there is no central authority that manages it. Who controls Bitcoin?

Bitcoin is controlled by the software used in the global network. The next question to ask is who controls what that software does?

There is a software foundation, Bitcoin Foundation controls the software. They work to maintain the software and propose changes to improve the software over time.

However, consensus is required by the Bitcoin network to approve software changes. A majority of the network must agree to software changes for them to be accepted.

The Bitcoin network has proven to be conservative with changes. There are participants who have wanted big changes in Bitcoin. When these were not approved, unhappy participants have over time spun off new cryptocurrencies using a process called forking. Forked cryptocurrencies are independent from Bitcoin. An example forked cryptocurrency is Bitcoin-Cash ($BCH).

Is Bitcoin Secure?

Bitcoin is very secure. The cases you read about concerning theft or loss of Bitcoin were not related to network security. These were cases of simple theft caused by people getting unauthorized access to PKs. It’s equivalent to someone stealing cash out of your wallet.

Bitcoin nodes do not have access to PKs. The only people who do are the owners of the Bitcoin.

It is possible but not practical to steal Bitcoin by approving transactions through consensus with enough nodes.

The design of Bitcoin discourages this practice because those resources can be used to instead earn Bitcoin by approving transactions. Over time, the network security has increased because the good actors drown out the bad actors. It would require a prohibitive amount of computing power to steal.

Generally, most people act with the good of the network in mind.

How Do I Get Bitcoin?

There are 4 ways to get Bitcoin:

- Someone sends you a PK.

- Buy a Bitcoin ETF.

- Buy Bitcoin at Custodial Exchange.

- Buy Bitcoin at an Exchange/Broker/Pay Service and use self custody with hardware/software.

The easiest way to get Bitcoin is buy a Bitcoin ETF, such as iShares Bitcoin Trust ($IBIT). If you want to own it directly, the easiest way is for someone to send you a PK that has value. Possession of the PK gives the authority to spend the Bitcoin. However, simply holding the PK is not advisable because the sender could spend the Bitcoin because they also know the PK.

What you want to do is to “spend” the Bitcoin so that it gets moved to a new address.

The way to do this is using a wallet. Wallets are implemented using desktop apps, crypto exchanges, dedicated hardware, and websites. Wallets can either be self custody (you control PKs) or custodial managed (third party PK control).

The person sending the Bitcoin will send it your wallet, which will move it to your address so that only you can spend it.

If you are buying Bitcoin “fresh” on an exchange with cash such as Coinbase, they will take care of this automatically.

A desktop app such as Exodus, you can get Bitcoin sent from others as well as buy it using third party payment services. In each case, your Bitcoin is “spent” so that you become the owner.

For beginners who want to directly own Bitcoin, we recommend that you start with Coinbase as it is full custodial. They hold your hand and provide excellent security without the need for self custody. Once you learn about how to secure Bitcoin with self custody, you might move on to other wallets, such as Exodus.

Why Would I Use Bitcoin?

No one needs Bitcoin. But, Bitcoin does provide some benefits that are noteworthy.

- Investors can use Bitcoin as a another store of value distinct from cash, stocks, bonds, and gold. Investors like options.

- Bitcoin serves as a worthy option for money in countries with high inflation. Bitcoin in its use and design is deflationary.

- Bitcoin can serve as money for people who don’t have access to banks, brokerages or other financial accounts.