What is the Coupon Extravaganza Portfolio (CXP)?

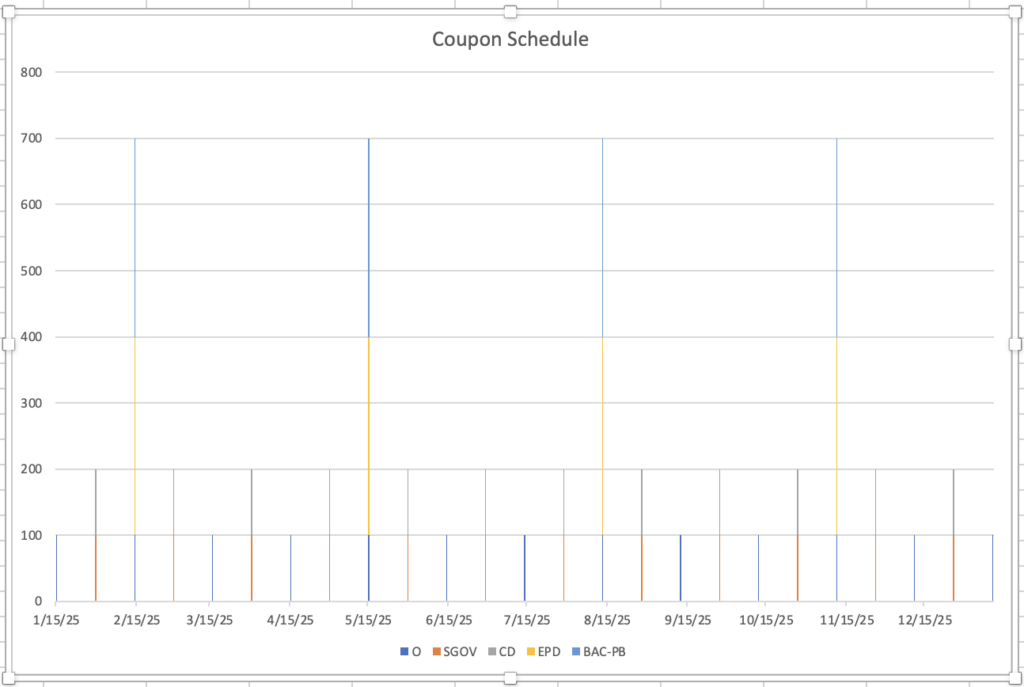

The CXP is a portfolio designed to provide income for 1 year. This simple portfolio with 4 investments pay coupons every 2 weeks.

Why is CXP Useful For?

The CXP is where you put your money for one year for maximum coupons. There are no coupons collected along the way every 2 weeks. After one year, you can then update how you want to invest the money, perhaps keeping or updating the investments.

This portfolio isn’t for people who want compounding and no coupons. If this is what you want, look for the Ultimate Compounding Portfolio.

What is The Income Yield?

The income yield is 5.33%.

What are the Main Benefits of the CXP?

- High Interest – You get the high interest, some fixed income mixed with market securities.

- Market Based Securities – These securities can be bought at most brokers who sell stocks, CDs and Treasury Bonds.

- Maximum Coupons – Coupons every 2 weeks!

What are the Risks of the CXP?

This portfolio mixes fixed income with market based securities. Risks:

- The market based securities (common stocks: $EPD, $O) can lose value over the portfolio term.

- Interest rate risk – $SGOV may offer less yield over time (or potentially more) due to the short term natures of the Treasury bonds it owns. These bonds rollover every 1-3 months.

- The preferred stock ($BAC-B) has interest rate and market price risk. This investment is for advanced investors.

How do I buy these Securities?

These securities can be bought at your broker or stock exchange.

How Do I Find These Securities? What is a CUSIP?

All securities sold in public markets are registered with Securities and Exchange Commission (SEC) with an identifier called a CUSIP. This includes common stocks, bonds, and CDs. Since CDs and bonds don’t have stock symbols, you need the CUSIP to find it at your broker.

CXP Portfolio – 01/26/2025

| Security | Name | Symbol | CUSIP | Description | Yield/YTM |

| Preferred Stock | Bank of America Corp., 6.00% Dep Shares Non-Cumulative Preferred Stock Series GG | BAC-PB | 60505229 | PS pays interest quaterly on the 16th of the month. | 6.00% |

| CD | MainStreet Bank VA | N/A | 56065GBY3 | CD pays monthly at month-end, matures 1/26/2026. | 4.20% |

| Common Stock | Realty Income | O | 756109104 | REIT, pays dividiend monthly on the 15th. | 5.75% |

| Master Limited Partnership (MLP) | Enterprise Product Partners, L.P. | EPD | 293792107 | MLP, pays dividend quarterly, 14th of the month. | 6.40% |

| Stock ETF | iShares 0-3 Month Treasury Bond ETF | SGOV | N/A | ETF pays interest every month at month-end | 4.30% |

Income Schedule