What is the I Prefer More Income Portfolio (PMP)?

The PMP is a portfolio designed to provide income from Preferred Stocks.

Why is PMP Useful For?

The PMP is where you put your money if you want higher interest than is available in lower risk assets such as Bank Accounts, Treasury Bonds, CDs or Money Market Funds.

What is The Income Yield?

The income yield is between about 6%. This is about 1.5% higher than lower risk assets.

What are the Main Benefits of the PMP?

- High Interest – You get more income, these provide higher interest.

- High Coupons – You will get multiple payments per quarter throughout the year.

- High Quality – The investments are from high quality companies, each with many decades of history.

- Market Based Securities – These securities can be bought at most brokers.

What Is Preferred Stock?

Preferred stock is a bond like investment that trades on the stock exchange. They are issued by institutions who need to borrow money from investors. They have two main benefits. First, they are priced low, sometimes as little as $25. This makes them accessible to more investors. Second they are easier to trade than bonds because they can be bought at your broker like a stock.

Preferred stocks are very similar to commercial debt. Fix rate, variable rate, convertible debt are some of the options. Pretty much what you find in the commercial debt market you will find in the preferred market.

Preferred stocks are generally considered riskier than regular commercial debt because they are lower ranked. This means that commercial debt holders get higher priority for interest payments.

Who Should Invest in the PMP Portfolio?

The PMP has been specifically designed to be accessible to many investors including beginners. The stocks selected are simple, fixed rate investments. This means that you get consistent interest for as long as you own them. The interest rate you get when you buy is what you get going forward.

The PMP portfolio does have risks as we will talk about. We don’t recommend this portfolio for risk adverse investors. If you are starting out in income portfolios and want more safety, we recommend the No Risk Portfolio or the Do Nothing Portfolio .

What are the Risks of the PMP?

We have selected securities that are very high quality and simple to understand. These stocks are from too-big-to-fail banks that are well known (Wells Fargo, Bank of America, JP Morgan). These banks can’t fail, you will get paid if you own these securities. Wall Street has credit ratings for these securities, but there is very little risk of failure to pay due to credit risk.

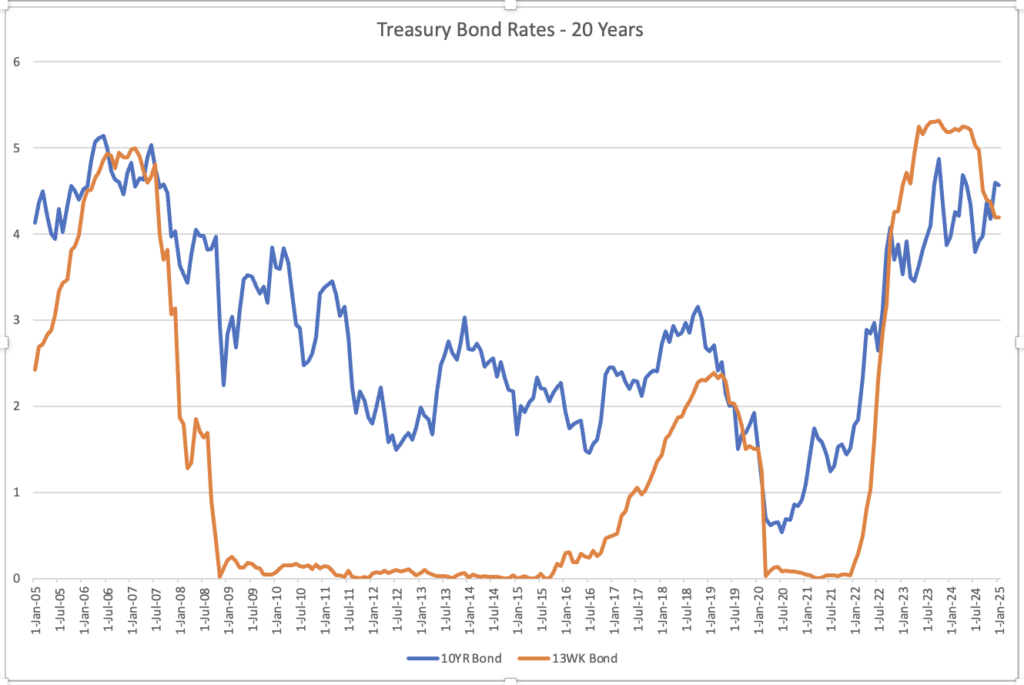

The main risk for these investments is interest rate risk. Preferred stocks earn a premium rate, or spread against risk free assets. The interest rate on risk free assets can affect the price of preferred stocks. Put simply:

- If short term rates rise, the price of preferreds may go down resulting in a paper loss on your principal.

- If short term rates drop, the price of preferreds may go up resulting in a paper profit on your principal.

The good news is that as of this writing in 2025, interest rates are close to the top of the cycle versus the bottom. This means that the more likely outcome is that you may earn a paper profit on these over time.

The chart below provides the historical view of Treasury Bond rates over 20 years. We use these bonds as a measure of the risk free rate.

How do I buy these Securities?

These securities can be bought at your broker or stock exchange. Common stocks have stock symbols that can be used to find the security easily. Preferred stocks have stock symbols but these can vary across brokers. If you are uncertain about getting the right security, use the CUSIP, it can verify that it is correct.

How Do I Find These Securities? What is a CUSIP?

All securities sold in public markets are registered with Securities and Exchange Commission (SEC) with an identifier called a CUSIP. This includes common stocks, bonds, preferred stocks, REITs, MLPs and CDs. Since preferred stocks don’t have consistent stock symbols across brokers, you may need the CUSIP to find it.

PMP Portfolio – 02/02/2025

| Name | Symbol | CUSIP | Description | Call Date | Yield/YTM |

| Bank of America Corp., 6.00% Dep Shares Non-Cumulative Preferred Stock Series GG | BAC-PB | 60505229 | Coupon paid quarterly, 16th of the month | 5/16/2023 | 6.00% |

| Bank of America Corp., 5.875% Dep Shares Non-Cumul Preferred Stock Series HH | BAC-PK | 60505195 | Coupon paid quarterly, 24th of the month | 7/24/2023 | 5.92% |

| Wells Fargo & Co., 4.70% Dep Shares Non-Cumul Class A Preferred Stock Series AA | WFC-PA | 94988U128 | Coupon paid quarterly, 15th of the month | 12/15/25 | 5.82% |

| Wells Fargo & Co., 4.375% Dep Shares Non-Cumul Class A Preferred Stock Series CC | WFC-PC | 95002Y202 | Coupon paid quarterly, 15th of the month | 3/15/2026 | 5.82% |

| JPMorgan Chase & Co., 6.00% Dep Shares Non-Cumul Preferred Stock Series EE | JPM-PC | 48128B648 | Coupon paid quarterly, 1st of the month | 3/21/24 | 5.97% |

| JPMorgan Chase & Co., 5.75% Dep Shares Non-Cumul Preferred Stock Series DD | JPM-PD | 48128B655 | Coupon paid quarterly, 1st of the month | 12/1/23 | 5.79% |