What is the Income Out The Wazoo Portfolio (WZP)?

The WZP is a portfolio designed to provide income for 1 year. It is an aggressive portfolio that uses many different types of investments available in the public markets.

Why is WZP Useful For?

The WZP is where you put your money for one year for the highest return.

What is The Income Yield?

The income yield is between about 10% to 14%, subject to how the investments work out. We explain this below.

What are the Main Benefits of the WZP?

- High Interest – You get the most income, it can offer income of about 10%-14%.

- High Coupons – You will get multiple payments per month, all throughout the year.

- High Quality – The investments are high quality companies, each with many decades of history.

- Market Based Securities – These securities can be bought at most brokers.

How Does The WZP Earn Income?

The investments in the WZP are market priced investments that are high income. Additionally, we use options to enhance the income. Options that are sold in the market against your positions earn extra money on top of the dividend or interest income you earn on the portfolio investments.

Income Sources:

- Dividend Income

- Interest Income

- Call Option Income

- Call Exercise Income

Who Should Invest in the WZP Portfolio?

The WZP portfolio is an advanced portfolio. Investors should understand how options work and the risks of them. We don’t recommend this portfolio for beginning investors. If you are starting out in income portfolios, we recommend the No Risk Portfolio or the Do Nothing Portfolio .

What are the Risks of the DNP?

The very first risk is that these securities are market priced. Market priced securities can result in losses are well as gains.

If you are uncomfortable with putting your “principal” at risk, this is not the portfolio for you. In the last section we offer two portfolios that do not put your principal at risk.

We have selected stocks of companies with very long track records of success and consistent income. However, it is always possible the market won’t agree and drop the stock prices a lot. If you needed to sell these securities after one year, you might sell for a loss.

How do I buy these Securities?

These securities can be bought at your broker or stock exchange. Common stocks have stock symbols that can be used to find the security easily. Preferred stocks have stock symbols but these can vary across brokers. If you are uncertain about getting the right security, use the CUSIP, it can verify that it is correct.

Options are identified by the underlying security (such as a stock), and option type, transaction type (buy/sell), the name and exercise date.

How Do I Find These Securities? What is a CUSIP?

All securities sold in public markets are registered with Securities and Exchange Commission (SEC) with an identifier called a CUSIP. This includes common stocks, bonds, preferred stocks, REITs, MLPs and CDs. Since preferred stocks don’t have consistent stock symbols across brokers, you may need the CUSIP to find it.

WZP Portfolio – 01/19/2025

| Security | Name | Symbol | CUSIP | Description | Maturity | Yield/YTM |

| Preferred Stock | Bank of America Corp., 6.00% Dep Shares Non-Cumulative Preferred Stock Series GG | BAC-PB | 60505229 | Coupon paid quarterly, 16th of the month | None | 6.00% |

| Common Stock | Realty Income | O | 756109104 | REIT, pays dividend monthly on the 15th. | None | 5.75% |

| Covered Call | Realty Income O 01/16/2026 57.50 C | O | Sell Covered Call | 1/16/26 | 4.30% | |

| Common Stock | Altria | MO | 02209S103 | Common Stock, pays dividend quarterly | None | 8.01% |

| Covered Call | Altria MO 01/16/2026 55.00 C | MO | Sell Covered Call | 1/16/26 | 4.40% | |

| Master Limited Partnership (MLP) | Enterprise Product Partners, L.P. | EPD | 293792107 | MLP, pays dividend quarterly | None | 6.40% |

| Money Market Fund | SCHWAB VALUE ADVANTAGE MONEY INVESTOR SHARES | SVWXX | Money Market Fund, pays dividend monthly | None | 4.19% |

WZP Portfolio – Yield

The portfolio consists of 100 shares of each of the stocks. The covered calls are each 1 contract for all 100 shares of $O and $MO stocks.

We also invest the option income in a Money Market Fund. In this example we use $SVWXX that is available at Charles Schwab. (For more MMF type options look at the Do Nothing Portfolio). The option income is received immediately when you open this portfolio so we put it in $SVWXX at initiation.

| Portfolio Cost | 16,130 |

| Dividend Income | 1,086 |

| Call Income | 475 |

| Cash Income | 20 |

| Total Income (Not exercised) | 1,581 |

| Total Income (Exercised) | 2,291 |

| Yield (Not Exercised) | 9.80% |

| Yield (Exercised) | 14.20% |

What is the Exercised Versus Not Exercised Yield?

The income on this portfolio starts at 9.8% but could go to 14.2% if the options are exercised.

The reason why the exercised yield is higher is that an exercised option earns a profit. The profit from the exercised call is added to your income. In order for the option to be exercised, both $O and $MO must trade above $55, usually at option expiration.

What are the Potential Outcomes?

There are different outcomes for this portfolio, evaluate each one based on what your expectations and goals are:

| Outcome | What It Means | What I Would Do |

| Bull Run – Options Exercised | The yield is 14.2% all positions are closed in cash. You will need to establish new positions if you need income. | Park the money in $SVWXX and evaluate new positions. |

| Bull Run, Options Not Exercised | The stock prices are higher but not high enough to trigger the option. The yield is 9.8% or possible 11-12% if you sell the positions outright. | If stocks are still good value hold on to them if no other better options are around. Look to sell more options. |

| Bear Run, Options Not Exercised, Still in Green. | The stocks are down from where you bought them. Adding in the option income, your effective price is still green. | If stocks are still good value hold on to them if no other better options are around. Look to sell more options. |

| Bear Run, Options Not Exercised, In the Red. | The stocks are down from where you bought them. Adding in the option income, your effective price is still down. | Use option income to buy more stock, then sell more options. |

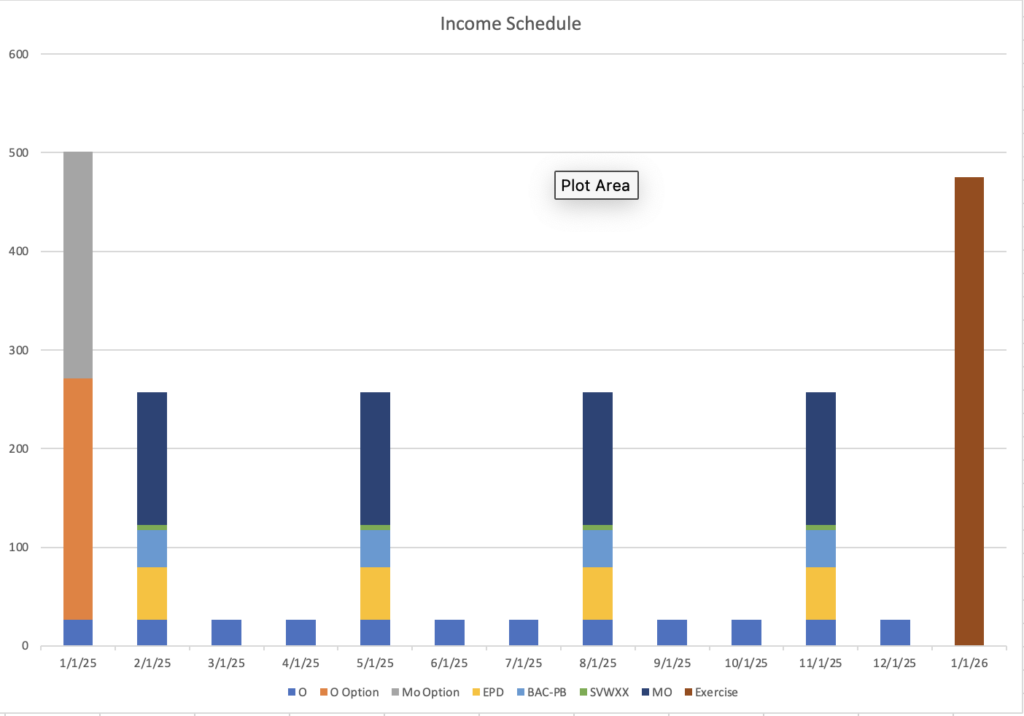

Income Schedule