If you are new to investing we recommend that you purchase index funds that track well known indices of well covered, successful company stocks. This is so easy to do and very cost efficient, you can make the case that virtually everyone should do it.

Picking stocks is hard. If you want to try to pick winners that will make great returns, it’s a job that requires some amount of time investment and focus. Even if you are successful, you need to make a return that is better than the index to make it worth your time.

Another option is to pay an active manager to pick stocks for you. Some managers do well but the overall track record of active managers is not great. Researching and picking a good active manager is itself a job that requires time and effort.

So you see we come back to index funds which check a lot of boxes in investing.

What Is Index Investing?

Index investing a strategy where a basket of investments are chosen using predefined criteria. The index creator doesn’t make a judgement about companies, it comes down to the criteria that determines if the stock is included.

This may sound like it’s a dart board, but it is not.

The criteria used for well known popular index funds are able to determine ‘usual suspects’, that are successful companies you would want to own. The highest level criteria are sector/speciality and market cap.

Let’s say that you wanted to invest in health care insurers. Within that sector/specialty, you will want to consider various companies of different sizes. The market capitalization of each company is the value of the company (share price * number of shares).

The market cap of a company can tell you quite a lot. A company that maintains or improves its market cap over time is a very good indictor of the “market opinion” of the quality and success of the company.

Also, the market cap can indicate where in the spectrum the company is in business size. Large, well known companies have higher market caps, while smaller companies who are specialized or growing might have smaller market caps.

Why Is Indexing A Successful Strategy?

If you were picking stocks, you might think that you could use some reasonable criteria to achieve an edge. Examples include: business quality, revenue/earnings growth, product market share, past performance, and many other criteria.

Under this thinking, you would pick companies that are, in summary, successful and have every reason to continue to succeed.

The problem with this line of thinking is that everyone else is trying to do the same thing. If there is a positive consensus on certain companies about their future, the price of these stocks will be bid up.

If the price of the stock is bid up too high, future returns could be hampered.

Companies that are not seen as being the highest quality could be under owned. There may be some circumstances that make these lower valued companies a better investment. (We will cover an example of this in a coming section).

Also, if the quality companies don’t actually deliver what the market expects, you could in the end find yourself will large losses.

So, stock picking is hard. Successful picking is about picking companies who offer the possibility of a better return, over the current expectations and valuation. Earnings drive valuations over the long term, and it isn’t a given that you can pick companies that will outperform the market.

When you index, you don’t make any choices, because you own all the companies. If a small group of companies outperforms unexpectedly you get the return because the index includes them. Also, if those well known, high quality companies outperform, you get that return, too.

What Index Funds Are Available?

Index funds can be created on virtually any criteria. Once the criteria are defined, it becomes a mechanical approach to simply purchase those securities that are determined from the criteria.

There are thousands of indexes, Yahoo Finance has a list of over 42,000 here. Creating an index is not hard, but not all indexes have registered securities for sale. The most popular indexes have dozens of securities offered from many firms. We will discuss the most popular ones shortly.

There isn’t enough time and space to discuss all index securities out there so we will focus on a key player. If you want an authority on indexes, start with one of innovators, Vanguard.com. Back in 1975, Vanguard created a business built around indexing well before most investors knew about the strategy.

If you go on the Vanguard personal investing site you will find over 200 individual index funds. If you want to get started with index investing, this is not a bad place to start. There is a lot of good information on this website.

Vanguard prides itself on being accessible and low cost. The success of Vanguard has affected the entire industry, other companies have had no choice but to lower costs and increase accessibility.

What Are The Characteristics of the Most Popular Indexes?

At Vanguard there are over 200 index funds. It might seem overwhelming to consider such as large list, but they are organized using only a small list of criteria. Once you understand these criteria, you can pretty much describe over 80% of the securities in the index markets. This is not a trade secret, many other firms do the same kind of security organization strategy.

The following 12 sectors are the “building blocks” of indexing and also the economy. Wall Street slices up stocks and bonds into these 12 distinct categories. These “blocks” can be organized, combined and sliced into many securities, but really this is what the economy looks like in the public markets.

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Health Care

- Industrials

- Information Technology

- Materials

- Real Estate

- Utilities

- Fixed Income

Once you filter by these sectors, there are other criteria that are used to further specify what stocks you want to include. These criteria are the most popular and widespread. It isn’t comprehensive, but once you understand these basics, you are on your way to seek other options if you want.

| Criteria | ||

| Market Cap | Company Value | Small Cap Mid Cap Large Cap |

| Asset Class | Company Style | Growth Value Blend |

| Region | Geographic Region | US International |

| Fixed Income Maturity | Bond Term | Short Intermediate Long |

| Fixed Term Credit Quality | Credit Quality | High Medium Low |

At Vanguard, the large cap market is better represented because it has more options. For example, at Vanguard you can invest in all the individual sectors specifically in its own security. For example, if you want just the Information Technology Sector Large Cap, this is represented by the ETF $VGT or the mutual fund, $VITAX. We will explain the difference between ETFs and mutual funds shortly.

In the small cap world, sector investing is not offered, but you do get options based on Asset Class (Growth, Value, Blend).

Most of the index offerings are explained by variations on these criteria, such as:

- All sector index fund, such as S&P500 Large Cap Index which includes all stock sectors and no fixed income.

- Blended funds, which combine stocks with fixed income.

- Geographic funds, such as All World, or International Only.

- Growth stocks only or Value Stocks only.

- Fixed income specific to maturity, such as a Long Term Bond ETF.

When you look at individual securities in the index world, you will see that most use some form of this basic criteria, perhaps adding an additional spin. It’s up to you to determine what makes sense, though, in the last section we suggest where you should start.

The Difference between Index ETFs and Index Mutual Funds

When you look at the list of index securities at Vanguard, you will see some specified as ETFs, while others are are called Funds. You might be wondering what these mean and how it impacts your ability to invest.

Let’s start by explaining what a mutual fund is. A mutual fund is the larger category of financial instrument that contains within it, index funds. Other type of funds that are mutual funds are so called active funds, which are managed by teams of people who select investments on a day to day basis.

Mutual funds are baskets of investments offered and managed by an investment company. Typically, the investor needs to be an account holder at the investment company. Another way of saying this is that the mutual fund is “captive” at the firm, which means that you can’t own the fund unless you are an account holder.

Over time, funds have become less captive because investment companies enter into agreements so that unaffiliated brokers can offer the funds. However, generally, the funds are still not widely available outside the investment company.

Another case where you might find a “cafeteria” style of funds (a set of mutual funds offered by different managers) is at your employer. It is very common for work retirement plans (such as 401(k)s and 403(b)s) to offer mutual funds from different investment managers.

Enter ETFs.

ETFs are registered securities that trade on stock exchanges just like stocks. What this means is the the investment company takes the mutual fund and replicates its investment strategy into another security that trades like a stock.

This opens up a whole new angle because this means that any broker can trade the ETF because all registered securities at an exchange are available. So as a practical matter any broker can trade a Vanguard ETF or anyone else’s ETF as well.

The choice comes down to where you are doing your trades. Generally, the ETFs do cost a bit more in management fees, but nothing that breaks the bank. One additional benefit is that it is efficient and easy to move ETF positions among brokers.

How Does Indexing Help With Investment Returns?

We talked in a previous section about how hard stock picking is. To be more specific, stock picking is doable and it is possible to succeed at it. However, the hard part is not the picking, but the action or sometimes, inaction required to succeed. Long term stock success requires lots of patience and inaction.

If you are picking stocks, you might be tempted to trade in and out of stocks based upon news, company performance, economic factors or hundreds of other reasons. The thinking is that you will be able to determine when to be an owner and when to be a seller because you will use smart criteria based upon timely information.

It isn’t this easy.

Indexing helps because you are forced to hold on to companies as long as the index keeps owning it. Holding companies with competitive advantages over the long term is the secret sauce for investment success. However, this is not as popular a strategy because people think they can outsmart the market.

This, of course, presumes that you don’t sell the index fund or ETF as well. We encourage you to hold on to your investment over the long term, unless there is some really good reason why you need to sell it.

Another reason indexing helps with returns is that you can capture returns that stock pickers might miss. Let’s look at a recent example.

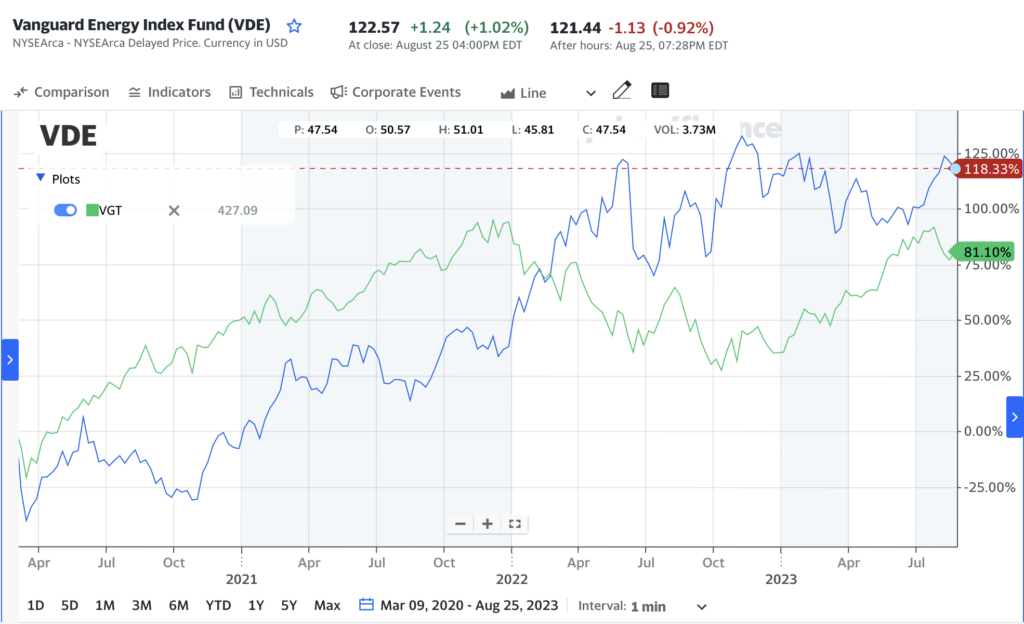

Coming out of the 2020 Global Pandemic, which economic sector performed the best?

If you were thinking Technology, you would get partial credit because Technology did actually perform well. The reason is that people needed technology more during the pandemic due to the restrictions on people meeting in person.

The actual answer was the Energy Sector! Energy was performing poorly over the previous years, but did really well after the pandemic. The reasons are that energy use increased over time, but the pandemic caused energy companies to limit supplies based upon supply chain and personnel issues.

In the chart above, we have the Vanguard Energy Index Fund ($VDE) charted against the Vanguard Information Technology ETF ($VGT). As shown, the return for Energy was over 118%, while Technology returned about 81% over the same 3 year timeframe.

Those who indexed in a diversified fund got that return with no effort.

Where Should I Start Indexing?

If you are new to investing, or even if you are not, the best place to start is with a diversified index fund with U.S. based companies across the many economic sectors of the economy.

This is very easy because what I just described is the S&P500 Index Fund. At Vanguard, this is known as Vanguard 500 Index Fund Admiral Shares ($VFIAX) or the equivalent ETF, Vanguard S&P 500 ($VOO).

It contains all 11 sectors mentioned in the previous section (does not include Fixed Income). It also checks a lot of boxes for diversification. Even though the companies are U.S. based stock listings, most of the companies in the index have significant international business. Also, the index includes a “blend” of both Growth and Value styles.

This has been the performance of this index over time.

This performance is as of 07/31/2023. Over the past 10 years, it has returned over 12%/year.

Summary

This has been an introduction to index fund and ETF investing. Because of innovators like Vanguard, investing in high quality companies across the economic spectrum has never been easier. In 1975 when Vanguard was founded, it was very difficult and costly to reproduce the diversification and breath of the index funds offered by Vanguard as well as other firms.

You needed a broker to put the list together and buy the stocks individually. Another option was actively managed mutual funds, but these were very costly by comparison. It’s great time to be an investor.